The Four-Legged Medicare stool

Traditional Medicare contains four ‘parts’. Part A (inpatient coverage), Part B (outpatient coverage) Medicare Supplement a.k.a. “MediGap” (Plan G being the most comprehensive) and Part D which ensures you have coverage for outpatient prescription drugs. Below is more information about each part of Traditional Medicare and the costs related to each.

When can I sign up for Medicare Part A (inpatient) & Part B (outpatient)?

When you’re first eligible for Medicare, you have a 7-month Initial Medicare enrollment period to sign up for Part A and/or Part B. For example, if you are eligible when you turn 65, you can sign up during your 7-month initial Medicare enrollment period. It begins 3 months before the month in which you turn 65, includes the month in which you turn 65 and ends 3 months after the month in which you turn 65.

To sign up for Medicare Part A (inpatient coverage) and Medicare Part B (outpatient coverage) click this link from the Social Security website at SSA.gov.

General Enrollment Period for Medicare

If you didn’t sign up for Part A and/or Part B (for which you must pay premiums) when you were first eligible and you aren’t eligible for a Special Enrollment Period (see below), you can sign up during the General Enrollment Period between January 1–March 31 each year. In that scenario, your coverage will start on July 1st. You may have to pay a higher premium for late enrollment in Part A and/or a higher premium for late enrollment in Part B.

National Open Enrollment Period for Medicare

If you miss the General Enrollment Period, you cannot apply again until the National Open Enrollment period begins on October 15th and ends on December 7th. In this scenario, your coverage will not begin until July 1st of the following year. You will also have to wait to enroll in Part D (outpatient prescription drug coverage) until the next National Medicare Open Enrollment period begins again on October 15th and ends on December 7th. You can also change your Part D plan and Medicare Advantage plan during this window with no underwriting (guaranteed issue) but the change will not become effective until January 1st.

Special Enrollment Periods for Medicare

Once your initial Medicare enrollment period ends, you may still be able to sign up for Medicare during a Special Enrollment Period. If you’re covered under a group health plan based on current employment, you have a Special Enrollment Period to sign up for Part A and/or Part B any time as long as you or your spouse (or family member if you’re disabled) is working, and you’re covered by a group health plan through the employer or union based on that work.

You also have a 6-month Special Enrollment Period to sign up for Part A and/or Part B that starts the month after the employment ends or the group health plan insurance based on current employment ends, whichever happens first. Usually, you don’t pay a late enrollment penalty if you sign up during a Special Enrollment Period.

Regulatory update in the state of Illinois effective January 1, 2022.

On January 1, 2022, Public Act 102-42 becomes law in the state of Illinois. On that date, all Illinois residents between the ages of 65 and 75 can switch to a new Medicare Supplement (a.k.a. “MediGap”) policy with the same carrier that is equal in design (or provides fewer benefits) regardless of their health status (Guaranteed Issue) during an annual open enrollment period. That annual open enrollment commences on their birthdate and continues for a 45 day period.

Monthly costs for Medicare

Most taxpayers do not pay a premium for Medicare Part A but Medicare Part B requires a base monthly premium. The standard Part B monthly premium in 2023 is $164.90 (increasing to $174.70 in 2024) or single tax filers with a M.A.G.I. – Modified Adjusted Gross Income – of less than $97,000 and less than $194,000 for married couples who file jointly. For those with a higher M.A.G.I there will be an I.R.M.A.A – Income Related Monthly Adjustment Amount – added to both Part B and Part D premiums in 2023. See the charts below. Also, the annual deductible for all Medicare Part B beneficiaries is $226 in 2023 and will increase to $240 in 2024. Click “Medicare & You” below to download the 2024 official U.S. government handbook.

2024 Part B premiums & IRMAA – Income Related Monthly Adjustment Amounts

On October 12, 2023, the Centers for Medicare & Medicaid Services (CMS) released the 2024 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs, and the 2024 Medicare Part D income-related monthly adjustment amounts.

The Medicare Savings Programs (MSPs) help more than 10 million people with coverage of Medicare premiums and, in most cases, other cost sharing. In their continued efforts to improve access to health care and lower costs for millions of Americans, the Department of Health and Human Services (HHS), through CMS, recently finalized a rule to streamline enrollment in MSPs, making coverage more affordable for an estimated 860,000 people. In addition, the Part D low‑income subsidy (LIS) helps pay for the Part D premium and lowers the cost of prescription drugs. Further, the Inflation Reduction Act recently expanded the number of people eligible for full LIS.

Medicare Part B Premium and Deductible

Medicare Part B covers physicians’ services, outpatient hospital services, certain home health services, durable medical equipment, and certain other medical and health services not covered by Medicare Part A.

Each year, the Medicare Part B premium, deductible, and coinsurance rates are determined according to provisions of the Social Security Act. The standard monthly premium for Medicare Part B enrollees will be $174.70 for 2024, an increase of $9.80 from $164.90 in 2023. The annual deductible for all Medicare Part B beneficiaries will be $240 in 2024, an increase of $14 from the annual deductible of $226 in 2023.

The increase in the 2024 Part B standard premium and deductible is mainly due to projected increases in health care spending and, to a lesser degree, the remedy for the 340B-acquired drug payment policy for the 2018-2022 period under the Hospital Outpatient Prospective Payment System.

Beginning in 2023, individuals whose full Medicare coverage ended 36 months after a kidney transplant and who do not have certain other types of insurance coverage can elect to continue Part B coverage of immunosuppressive drugs by paying a premium. For 2024, the standard immunosuppressive drug premium is $103.00.

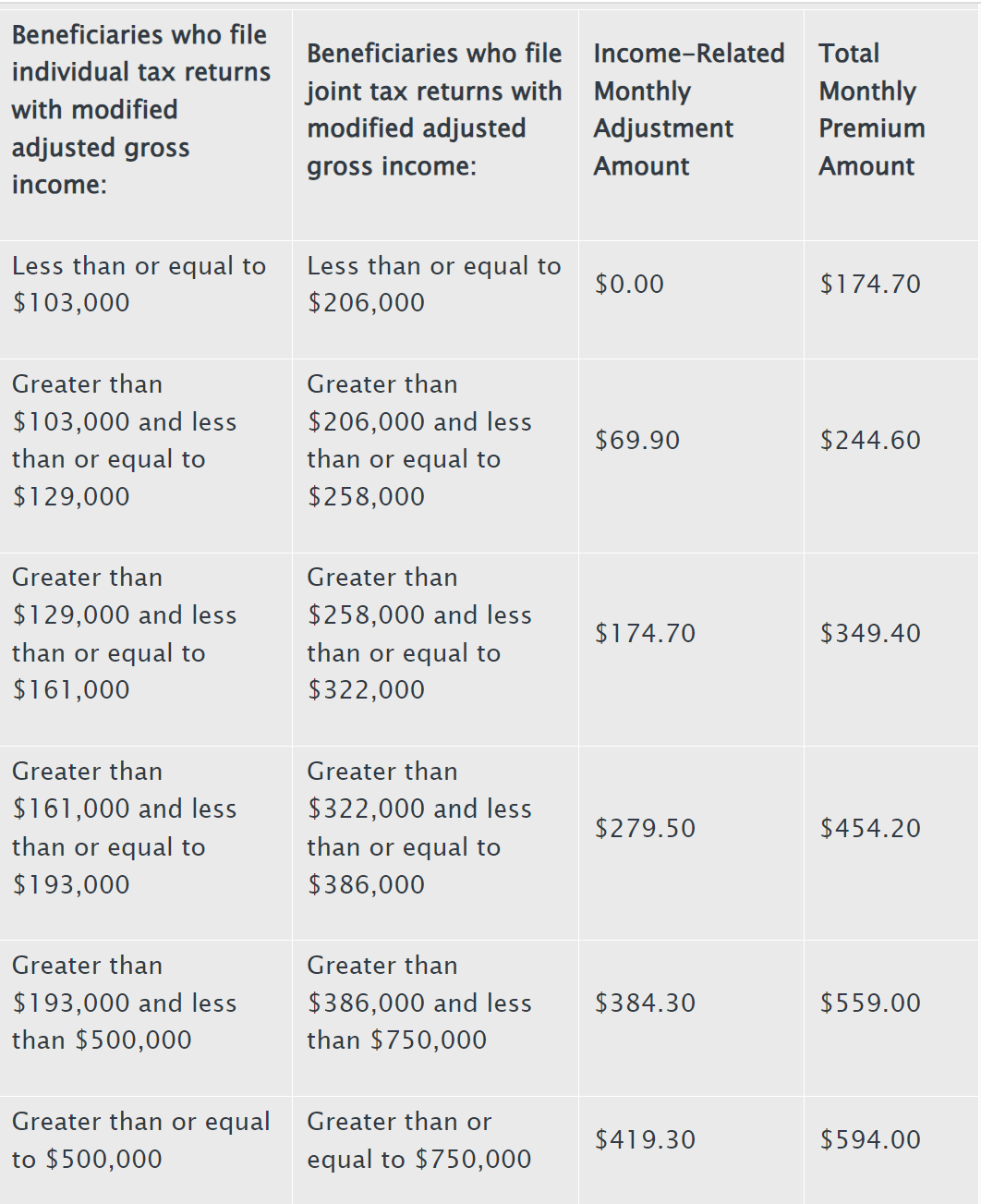

Medicare Part B Income-Related Monthly Adjustment Amounts

Since 2007, a beneficiary’s Part B monthly premium has been based on his or her income. These income-related monthly adjustment amounts affect roughly 8 percent of people with Medicare Part B. The 2024 Part B total premiums for high-income beneficiaries with full Part B coverage are shown in the following table:

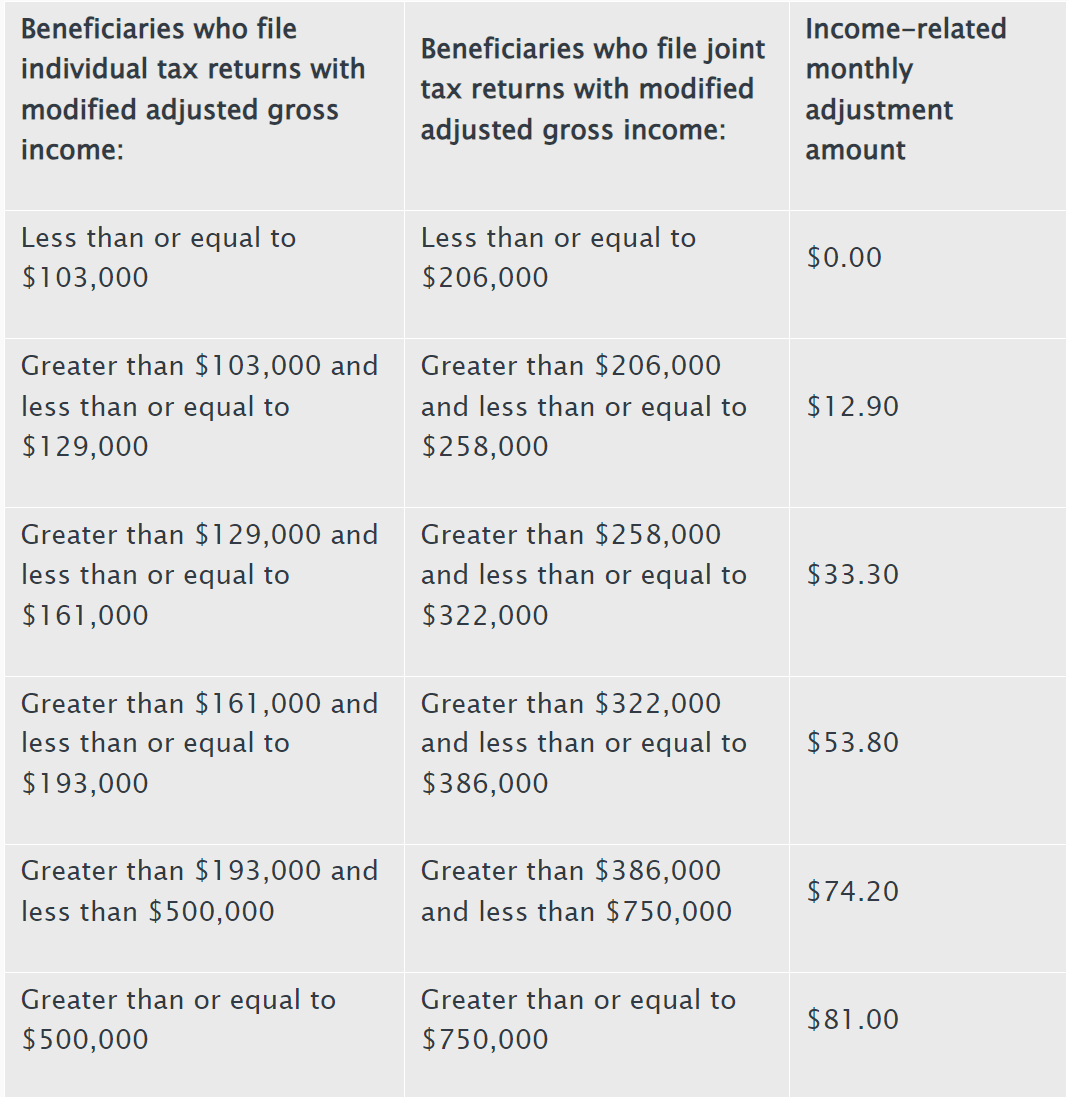

Medicare Part D Income-Related Monthly Adjustment Amounts

Since 2011, a beneficiary’s Part D monthly premium has been based on his or her income. These income-related monthly adjustment amounts affect roughly 8 percent of people with Medicare Part D. These individuals will pay the income-related monthly adjustment amount in addition to their Part D premium. Part D premiums vary plan and regardless of how a beneficiary pays their Part D premium, the Part D income-related monthly adjustment amounts are deducted from Social Security benefit checks or paid directly to Medicare. Roughly two-thirds of beneficiaries pay premiums directly to the plan while the remainder have their premiums deducted from their Social Security benefit checks. The 2024 Part D income-related monthly adjustment amounts for high-income beneficiaries are shown in the following table:

Reducing IRMAA when your income declines:

If at any point your income falls below the columns above you do not have to wait until you file your tax return in order to reduce or eliminate the I.R.M.A.A. upcharge. Instead, complete form SSA-44 and then take it to your local Social Security office. After review, your I.R.M.A.A. upcharge will either be reduced or eliminated based on the evidence you provide proving a reduction in income.

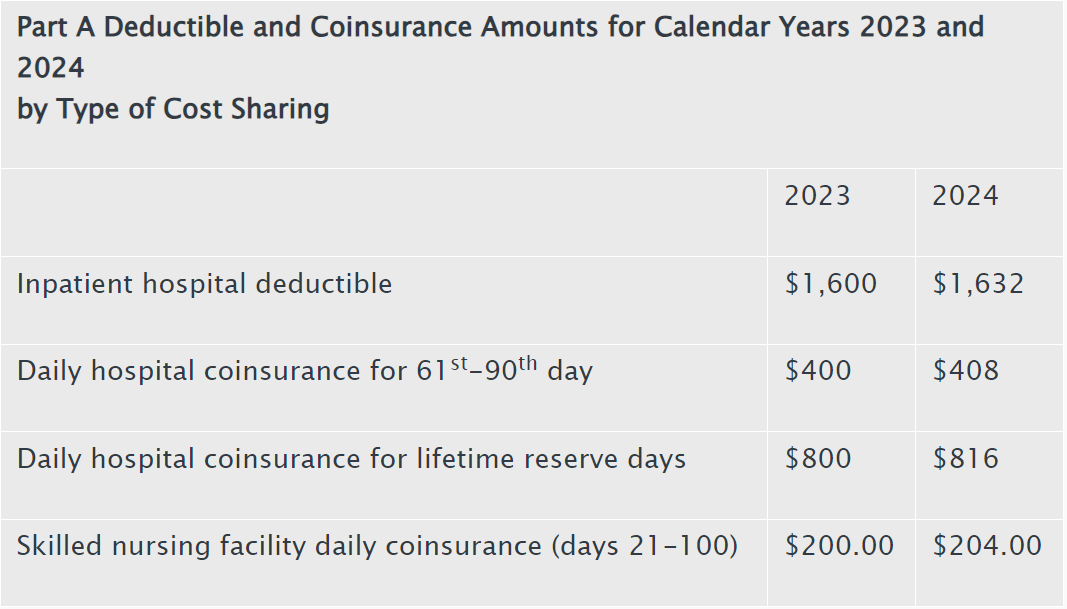

Medicare out of pocket expenses without Medicare Supplement

Without a Medicare Supplement (“MediGap”) policy you are exposed to these Medicare Part A & B out of pocket expenses outlined below:

Medicare Part Premium and Deductible

Medicare Part A covers inpatient hospitals, skilled nursing facilities, hospice, inpatient rehabilitation, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment, as determined by the Social Security Administration.

The Medicare Part A inpatient hospital deductible that beneficiaries pay if admitted to the hospital will be $1,632 in 2024, an increase of $32 from $1,600 in 2023. The Part A inpatient hospital deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period. In 2024, beneficiaries must pay a coinsurance amount of $408 per day for the 61st through 90th day of a hospitalization ($400 in 2023) in a benefit period and $816 per day for lifetime reserve days ($800 in 2023). For beneficiaries in skilled nursing facilities, the daily coinsurance for days 21 through 100 of extended care services in a benefit period will be $204.00 in 2024 ($200.00 in 2023).

Enrollees age 65 and older who have fewer than 40 quarters of coverage and certain persons with disabilities pay a monthly premium in order to voluntarily enroll in Medicare Part A. Individuals who had at least 30 quarters of coverage or were married to someone with at least 30 quarters of coverage may buy into Part A at a reduced monthly premium rate, which will be $278 in 2024, the same amount as 2023. Certain uninsured aged individuals who have less than 30 quarters of coverage and certain individuals with disabilities who have exhausted other entitlement will pay the full premium, which will be $505 a month in 2024, a $1 decrease from 2023.

Immunosuppressive drug usage:

Beginning in 2023, certain Medicare enrollees who are 36 months post kidney transplant and no longer eligible for full Medicare coverage, can elect to continue Part B coverage of immunosuppressive drugs by paying a premium. For more information click here.

When can I buy Medicare Supplement a.k.a. “MediGap”?

During your Initial Medicare enrollment period.—A one‑time-only, 7-month period when federal law allows you to buy any Medicare Supplement policy you want that’s sold in your state. It starts in the first month that you’re covered under Medicare Part B, and you’re 65 or older. During this period, you can’t be denied a Medicare Supplement policy or charged more due to past or present health problems. Some states (like Illinois) now have additional Open Enrollment rights under state law.

If you miss this initial Open Enrollment period, you have other guaranteed issue rights depending on the circumstance outlined in detail in this document provided by CMS – Centers for Medicare and Medicaid Services.

If you still do not qualify during the Special Circumstances outlined in that document, there is one carrier in Illinois that will issue you a Medicare Supplement policy any time throughout the year on a guaranteed issue basis (no preexisting conditions) regardless of your age or health history. That carrier is Blue Cross Blue Shield of Illinois.

When can I buy Medicare Advantage and Part D for outpatient prescription drug coverage?

Open Enrollment Period for Medicare Advantage (Part C) and Medicare Part D – for prescription drugs is October 15th through December 7th. We do not recommend Medicare Advantage. The maximum out of pocket costs are $8,850 and recent reporting has exposed systematic denial of claims by Medicare Advantage insurers. Starting in 2023, CMS – Centers for Medicare & Medicaid Services – will begin restricting television ads for Medicare Advantage and will begin to scrutinize agents and brokers who sell them due to extremely high complaint volumes. This September 2023 article from Barron’s Financial and Investment news details the onerous ramifications of making the wrong choice when it comes to Medicare. This October 2023 article from the Wall Street Journal provides guidance on avoiding “big mistakes” when it comes time for Medicare. The biggest mistake of all is enrolling in Medicare Advantage.

Outpatient prescription drug coverage via Medicare Part D

In 2023, the Medicare part D deductible is $505 annually. In 2024, the Medicare Part D deductible will increase to $545. That deductible is only required to be paid for outpatient prescription drugs that are considered Tier 2 Generic and “Brand name drugs” as well as Specialty drugs. On most insurance company formulary lists, those drugs are considered “Tier 3” or higher. If you are not taking Tier 2 Generic drugs or Brand name or Specialty drugs when you are first eligible for part D you may be best positioned by purchasing the lowest priced part D plan available in your area because again, there is no deductible required on most part D plans for Tier 1 Generic drugs.

There are four payment stages with a Medicare part D plan.

1.) Deductible (required for Tier 2 Generic and Brand and Specialty drugs only)

2.) Initial coverage period

3.) Coverage ‘gap’ (formerly known as the “Donut hole”)

4.) Catastrophic

There are many Medicare part D plans available to purchase once you have your Medicare part A (inpatient) and Medicare part B (outpatient) coverage in place. To determine which part D plan is best for you, please visit this page of the Medicare.gov website and click on “Drug Plan (Part D)”. Then, enter your zip code and county. Then, begin by entering the names and dosages of all of your current outpatient prescription drugs. The system will then provide an unbiased list of the part D plans that will expose you to the lowest annual out of pocket expense based on total expenditures in both premiums, co pays, deductibles and coinsurance. The Part D plan listed at the top of the first page is the plan you should purchase because that will be the plan that will expose you to the lowest out of pocket expense which includes your monthly premium, copays and the annual deductible (if applicable).

Changes to Part D via 2022 I.R.A. – Inflation Reduction Act

In 2022, congress passed the Inflation Reduction Act. Besides implementing government price controls on certain prescription drugs, it also made the following changes to Part D which will result in lower out of pocket costs for Part D policyholders:

Caps out-of-pocket spending for Medicare Part D enrollees & makes other Part D benefit design changes, beginning in 2024

Limits monthly cost sharing for insulin to $35 for people with Medicare, beginning in 2023

Eliminates cost sharing for adult vaccines covered under Medicare Part D and improve access to adult vaccines in Medicaid and CHIP, beginning in 2023

Expands eligibility for full benefits under the Medicare Part D Low-Income Subsidy Program, beginning in 2024

Principal Broker, C. Steven Tucker joined Dan Proft and Amy Jacobson on Chicago’s Morning Answer to discuss the impact of the “Inflation Reduction Act” on Medicare Part D and enhanced ACA health insurance subsidies now extended until 2026 – 08/17/2022. Replay below:

Scroll down to download the official C.M.S. guides to Medicare Parts A and B, Medicare Supplement plans a.k.a. “MediGap” plans and Medicare Advantage Plans.

One of the most common questions we receive about Medicare supplement insurance is how it differs from a Medicare Advantage plan. Below are 5 basic differences for you to consider. In our view, Traditional Medicare with a Medicare supplement policy is the best option for seniors looking to fill in the gaps left by basic Medicare. This is especially true after the U.S. Department of Health and Human Services Office of Inspector General released this detailed report on April 27, 2022 which detailed millions of medically necessary claims that were denied by Medicare Advantage insurers “in an attempt to increase profits“. Starting in 2023, CMS – Centers for Medicare & Medicaid Services – will begin restricting television ads for Medicare Advantage and will begin to scrutinize agents and brokers who sell them due to extremely high complaint volumes. This September 2023 article from Barron’s Financial and Investment news details the onerous ramifications of making the wrong choice when it comes to Medicare. This October 2023 article from the Wall Street Journal provides guidance on avoiding “big mistakes” when it comes time for Medicare. The biggest mistake of all is enrolling in Medicare Advantage.

Consider the following:

1.) Medicare Advantage plans are NOT Medicare Supplements. Medicare Supplements and Medigap are interchangeable terms – the two terms refer to the same type of standardized plans that work with Medicare. Medicare Advantage plans do NOT “supplement” Medicare; they take the place of it.

2.) Medicare Advantage plans have widely varying benefits that can be found on plan “Summary of Benefit” documents. These range from plan to plan, change each year, and are very long (i.e. different co-pays for different procedures, in-network vs. out of network, etc.). Medicare Supplement plans are all required to go by the Federally-standardized plans chart.

3.) The plans work very differently. The easiest way to explain it is that Medicare Supplement/Medigap plans pay AFTER Medicare pays. They “supplement” Medicare. Medicare Advantage plans pay INSTEAD of Medicare. More importantly, the U.S. Department of Health and Human Services Office of Inspector General released this detailed report on April 27, 2022 which detailed millions of medically necessary claims that were denied by Medicare Advantage insurers “in an attempt to increase profits“. Starting in 2023, CMS – Centers for Medicare & Medicaid Services – will begin restricting television ads for Medicare Advantage and will begin to scrutinize agents and brokers who sell them due to extremely high complaint volumes. This September 2023 article from Barron’s Financial and Investment news details the onerous ramifications of making the wrong choice when it comes to Medicare. This October 2023 article from the Wall Street Journal provides guidance on avoiding “big mistakes” when it comes time for Medicare. The biggest mistake of all is enrolling in Medicare Advantage.

4.) Medicare Advantage plans have an annual enrollment period at the end of each year. This is because the plans change, benefits and premium, each year. Medicare Supplement plans do NOT have an annual enrollment period. You can change plans at any time of the year, but the benefits never change on these types of plans.

5.) The ‘M.O.O.P.” – Maximum Out Of Pocket – risk with Medicare Advantage plans is $8,850 each year.

No Network Restrictions

Any doctor, hospital, or other medical provider that accepts Medicare must accept your Medicare supplement insurance plan. You can choose to see any doctor in any city when you want. This is not the case with most Medicare Advantage “Part C” plans since many Medicare Advantage plans are coupled with an HMO which limits your choices as to which doctors or hospitals you can choose from.

Easy To Compare Plans

All Medicare supplement insurance policy are standardized. This means that you can be sure that plans from different companies all have the exact same coverage (plan designated by letter – C, F, N, etc…)

Stable Pricing

While some companies have rate increases each year, the premiums for your plans remain fairly steady. Especially if you work with an independent agent who can shop all the best companies for you.

No Restricted Enrollment or Change Deadlines

With a Medicare supplement insurance policy you can change your plan at any time for any reason. You don’t have to rush around at the end of the year worried about getting stuck in a bad plan. Of course health conditions play a factor when buying a new policy, but again a quality independent agency has multiple companies all with different underwriting guidelines.

You Can Cover 100% Of Out of Pocket Expenses

With certain Medicare supplement insurance plans you can cover every gap left my original Medicare. No co-pays, deductibles, or other shared costs. This makes budgeting for your Medicare care very easy. All you pay is your Medicare part B premium and your Medicare supplement insurance premium and everything else is taken care of. This is not the case with Medicare Advantage plans. Medicare Advantage plans have a “M.O.O.P” – Maximum Out Of Pocket cost each year of $8,300.

Medicare Plan F

Medicare Plan F used to be the most comprehensive Medicare Supplement plan available. Medicare plan F was replaced by Medicare plan G on January 1, 2020. To learn more about the new Medicare Supplement plan G click the tab below. The best priced any hospital, any doctor Medicare Supplement plans are available from Mutual of Omaha insurance company. Call us toll free at (866) 724-7123 to learn more about Medicare Supplement plan G from Mutual of Omaha or click the “Contact” button at the top of this page. To view the outline of coverage and a detailed comparison between all of the Medicare Supplement plans offered by Mutual of Omaha click this link.

Medicare Supplement Plan G

Medicare Supplement (“Medigap”) plan G is the best priced and best designed Medicare Supplement plan on the market today. Plan G is a new entry to the Medicare Supplement market. It covers everything Plan F (now discontinued) covered except it requires the policy holder to pay the $203 annual Part B deductible. Please note: The annual Medicare Part B deductible in 2023 is $226. In 2024, the annual Medicare Part B deductible will be increasing to $240. In exchange for this additional deductible, the premium is about $500 cheaper each year for Plan G than Traditional Plan F.

Medicare Part D

Outpatient prescription drug coverage under Medicare part D

There are many Medicare part D plans available to purchase once you have your Medicare part A (inpatient) and Medicare part B (outpatient) coverage in place. To determine which part D plan is best for you, please visit this page of the Medicare.gov website and click on “Drug Plan (Part D)”. Then, enter your zip code and county. Then, begin by entering the names and dosages of all of your current outpatient prescription drugs. The system will then provide an unbiased list of the part D plans that will expose you to the lowest annual out of pocket expense based on total expenditures in both premiums, co pays, deductibles and coinsurance.

Please note: Even if you have not been prescribed any outpatient drugs, you still need to purchase a part D plan to avoid being penalized for not doing so. The penalty gets larger the longer you wait to purchase part D so even if you are not taking any outpatient prescription drugs, you still need to purchase a part D plan to avoid the penalty which will be applied once you do enroll in part D, if you wait. Waiting until you ‘need’ part D can cost you a lot of money in penalties and those penalties are applied in perpetuity. So, it is best to avoid them by purchasing part D at the lowest price possible when you are first eligible to do so.

Medicare Part D deductible:

In 2022, the Medicare part D deductible is $480 each year. That deductible is only required to be paid for outpatient prescription drugs that are considered Tier 2 Generic and “Brand name drugs”. On most insurance company Formulary lists, those drugs are considered “Tier 3” or higher. If you are not taking Tier 3 drugs when you first are eligible for Medicare part D you may be best positioned by simply purchasing the lowest priced part D plan available in your area because again, there is no deductible required on most part D plans for Generic prescription drugs.

There are four payment stages with a Medicare part D plan.

1.) Deductible (required for Tier 2 Generic and Brand and Specialty drugs only)

2.) Initial coverage period

3.) Coverage ‘gap’ (formerly known as the “Donut hole”)

4.) Catastrophic

How Medicare Part D Works

Paying for prescription drugs can be quite costly, which is why Medicare Part D was created as part of the Medicare Prescription Drug, Improvement, and Modernization Act of 2003 (also known as the Medicare Modernization Act or MMA). Meant to help subsidize the cost of prescription drugs, Medicare Part D came into effect in 2006. Below is some general information on Medicare Part D and what to expect as a result of some changes in the future.

Those who have Medicare Part A and Medicare Part B are eligible for Medicare Part D. There are two options for receiving Medicare Part D benefits. One can choose to enroll in a Medicare Advantage plan with prescription drug coverage, or one can enroll in a Prescription Drug Plan (PDP). Enrollment for Medicare Part D lasts from November 15 through May 15 of the following year.

Changes to Medicare Part D under 2022 Inflation Reduction Act

There are four payment stages with a Medicare part D plan. They are:

1.) Deductible

2.) Initial coverage

3.) Coverage ‘gap’ (formerly known as the “Donut hole”)

4.) Catastrophic

In 2022, congress passed the Inflation Reduction Act. Besides implementing government price controls on certain prescription drugs, it also made the following changes to Part D which will result in lower out of pocket costs for Part D policyholders:

Caps out-of-pocket spending for Medicare Part D enrollees & makes other Part D benefit design changes, beginning in 2024

Limits monthly cost sharing for insulin to $35 for people with Medicare, beginning in 2023

Eliminates cost sharing for adult vaccines covered under Medicare Part D and improve access to adult vaccines in Medicaid and CHIP, beginning in 2023

Expands eligibility for full benefits under the Medicare Part D Low-Income Subsidy Program, beginning in 2024

Individuals who are eligible for Medicare will notice that there are certain gaps in medical treatment that are not covered by Medicare Pare A or Medicare Part B. To cover these gaps, there are multiple options available, but it fundamentally comes down to a choice of a Medicare Advantage plan (which is a private alternative to Traditional Medicare) or Traditional Medicare a Medicare Supplement insurance plan. When choosing between the two, you need to consider a number of different factors. Below are some general considerations for those deciding between Medicare Advantage plans and Traditional Medicare with a Medicare Supplement plan.

What are Medicare Advantage Plans?

Once referred to as Medicare + Choice and Medicare Part C, Medicare Advantage refers to health care plans provided by Medicare-approved private companies. Medicare Advantage plans will cover urgent care needs as well as emergency care needs. Medicare Advantage will also cover medical treatments in Original Medicare (Part A and Part B), with the exception of hospice care (which is covered by Original Medicare). Extra coverage may be offered through some Medicare Advantage plans, such as prescription drug coverage (Medicare Part D), dental care, eye care, and programs promoting health and wellness. That stated, the U.S. Department of Health and Human Services Office of Inspector General released this detailed report on April 27, 2022 which detailed millions of medically necessary claims that were denied by Medicare Advantage insurers “in an attempt to increase profits“. Starting in 2023, CMS – Centers for Medicare & Medicaid Services – will begin restricting television ads for Medicare Advantage and will begin to scrutinize agents and brokers who sell them due to extremely high complaint volumes. This September 2023 article from Barron’s Financial and Investment news details the onerous ramifications of making the wrong choice when it comes to Medicare. This October 2023 article from the Wall Street Journal provides guidance on avoiding “big mistakes” when it comes time for Medicare. The biggest mistake of all is enrolling in Medicare Advantage.

Medicare Advantage Plans may take the form of a Health Maintenance Organization (HMO) plan, Preferred Provider Organization (PPO) plan, or a Private Fee-for-Service (PFFS) plan. There are also Special Needs Plans (SNP) available for those who have certain severe medical conditions or disabilities. The most important reason to choose a MediGap or “Medicare Supplement” plan over a Medicare Advantage plan is the “M.O.O.P” – Maximum Out Of Pocket costs. These are capped at $8,850 each year. Out of pocket costs are little to nothing with Medicare Supplement plans. With Plan G they are capped at the Part B deductible which is $226 in 2023. The Part B deductible is increasing to $240 in 2024.

Medicare Supplement plan advantages over Medicare Advantage plans

While both types of plans can be viable options, there are a handful of very significant reasons why we believe Medigap plans to be more viable long-term and more advantageous. Chief among these is the “M.O.O.P” – Maximum Out Of Pocket” risk with Medicare Advantage plans. The M.O.O.P. is $8,850 each year with Medicare Advantage plans. More importantly, the U.S. Department of Health and Human Services Office of Inspector General released this detailed report on April 27, 2022 which detailed millions of medically necessary claims that were denied by Medicare Advantage insurers “in an attempt to increase profits“. Starting in 2023, CMS – Centers for Medicare & Medicaid Services – will begin restricting television ads for Medicare Advantage and will begin to scrutinize agents and brokers who sell them due to extremely high complaint volumes. This September 2023 article from Barron’s Financial and Investment news details the onerous ramifications of making the wrong choice when it comes to Medicare. This October 2023 article from the Wall Street Journal provides guidance on avoiding “big mistakes” when it comes time for Medicare. The biggest mistake of all is enrolling in Medicare Advantage.

Out of pocket costs are little to nothing with MediGap or “Medicare Supplement” plans. Below, you will find a list of facts about the plans that, we think you’ll agree, make Medigap plans the more prudent choice:

Medigap plans never change – they are guaranteed renewable and your benefits will never change. Medicare Advantage plans change on an annual basis. Their changes include formulary changes, benefit changes, network changes, premium changes, deductible changes, etc.

Medigap plans are not currently being threatened by recent health care reform changes which greatly reduced funding to the Advantage plans (which are Federally-subsidized). These recent changes led to many top Advantage plan providers pulling completely or partially out of this market (CIGNA, Wellcare, etc.). It is a universal assumption that Medigap plans have greater long-term viability and stability.

Medicare Advantage plans have deductibles, co-pays and coinsurance that can range from service to service. This is a complex system of co-pays and deductibles that, in a good year, may not be a problem, but if you have any health problems, can quickly add up to a large expense. These expenses are capped at $8,850 each year. In addition to the high out of pocket risk, recent reporting has exposed systematic denial of claims by Medicare Advantage insurers. Starting in 2023, CMS – Centers for Medicare & Medicaid Services – will begin restricting television ads for Medicare Advantage and will begin to scrutinize agents and brokers who sell them due to extremely high complaint volumes. This September 2023 article from Barron’s Financial and Investment news details the onerous ramifications of making the wrong choice when it comes to Medicare.

Medigap or “Medicare Supplement” plans, at the top few levels, have no (or very small) out of pocket costs. They are designed to fill in the gaps in Medicare. The top Medigap plan, which 43+% of people have, Medigap Plan F, fills in all the gaps in Medicare so you don’t have any out of pocket co-pays or deductibles at the doctor or hospital. Plan G replaced plan F on January 1, 2020.

Medicare Advantage plans have networks of doctors/hospitals that you must stay within to receive full coverage. These networks are, generally speaking, regional in nature. So if, for example, you are traveling, you may be hard pressed to find a doctor that works with your plan. Medicare Supplements can be used anywhere that takes Medicare, nationwide. If they take Medicare, they have to take one of the standardized Medigap plans, regardless of what insurance company it is.

When you are first eligible for Medicare, you can choose either type of plan – Advantage or Supplement – in your initial open enrollment period. After that point, you can always move from a Medicare supplement to a Medicare Advantage plan, because Advantage plans do not use medical underwriting. Regardless of your health (with the exception of ESRD), there are no pre-existing conditions. However, you can NOT always go the opposite way. In almost all states (NY, CA, MO are exceptions), Medicare Supplement companies use medical underwriting. This means you can be denied coverage or made to pay more for pre-existing conditions. Changes to Medicare Advantage – The Health Care Reform Bill

Changes to Medicare Advantage – The Health Care Reform Bill

On March 23, 2010, the Patient Protection and Affordable Care Act (PPACA) was signed into law. The provisions of this law not only apply to individuals, business owners, and health insurance companies, they will also have some effect on Medicare. While the PPACA will not require seniors to change their Medigap coverage, there are some changes that current and future Medicare recipients should be aware of. Below is a general look at some of the ways that the health care reform bill will alter Medicare.

Health Care Reform and Original Medicare Enhancements

While there will be no cuts for Original Medicare plans, there will be some enhancements in coverage as a result of health care reform. Medicare will start paying for wellness visits each year. As it stands at the moment, only a general check up is paid for when a person initially enrolls in Medicare.

Changes to Part D under 2022 Inflation Reduction Act

In 2022, congress passed the Inflation Reduction Act. Besides implementing government price controls on certain prescription drugs, it also made the following changes to Part D which will result in lower out of pocket costs for Part D policyholders:

Caps out-of-pocket spending for Medicare Part D enrollees & makes other Part D benefit design changes, beginning in 2024

Limits monthly cost sharing for insulin to $35 for people with Medicare, beginning in 2023

Eliminates cost sharing for adult vaccines covered under Medicare Part D and improve access to adult vaccines in Medicaid and CHIP, beginning in 2023

Expands eligibility for full benefits under the Medicare Part D Low-Income Subsidy Program, beginning in 2024

Health Care Reform & Medicare Advantage Spending Cuts

Medicare Advantage saw a number of spending cuts as a result of the health care reform bill, amounting to $156 billion over a decade. There was also a $40 billion reduction on Medicare payments for home health care and a $22 billion reduction on certain Medicare payments to hospitals. Those cuts resulted in our nation’s largest health insurer being forced to drop hundreds of doctors from their Medicare Advantage network. This adversely affected Medicare Advantage recipients all over the country. This resulted in a large and rapid response from the A.M.A. – American Medical Association, 43 national specialty societies, 40 state medical associations and several state Attorney Generals. All to no avail. The payment reductions were implemented, physician contracts were cancelled and many Medicare Advantage recipients switched back to Traditional Medicare with a Medicare Supplement plan. The ones who really suffered were the ones who could not afford to do so and they still today have less access to medical providers than those who can afford a Medicare Supplement plan.

There is also a new threat to the integrity of Medicare Advantage plans. That threat is coming from C.M.S. – Centers for Medicare and Medicaid Services. C.M.S. found more than $14 billion in overpayments which have been made in recent years under Medicare Advantage (most likely to compensate for the aforementioned cuts under the ACA) and now they want those overpayments back. If collected, that would cost health insurers that provide Medicare Advantage billions and that in turn will affect Medicare Advantage policy holders adversely. The U.S. Department of Health and Human Services Office of Inspector General released this detailed report on April 27, 2022 which detailed millions of medically necessary claims that were denied by Medicare Advantage insurers “in an attempt to increase profits“. Please read that report and the information below so you can make an informed decision. This September 2023 article from Barron’s Financial & Investment news details the onerous ramifications of making the wrong choice when it comes to Medicare.

Health Care Reform and the Medicare Payroll Tax

Individuals earning more than $200,000 a year and couples earning more than $250,000 a year will experience a 0.9% increase in their Medicare payroll tax. Beginning in 2013, individuals earning more than $200,000 a year and couples earning more than $250,000 a year will also experience a 3.8% surtax on investment income.

Still have questions? Call us at (630) 674-1551 for a free no obligation Medicare Supplement telephone consultation from one of our multi-state licensed Brokers. Remember, it costs you nothing more to use a Broker.