September was LIAM

Life Insurance Awareness Month.

MVP quarterback and sportscaster Boomer Esiason is raising awareness about the necessity of Life insurance. His mother died when he was only seven years old. His life was more difficult because his mother had no life insurance. Today more than 95 million adult Americans have no life insurance. To determine how much life insurance you need click here.

Get Life Insurance Quotes Now

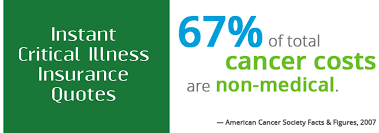

Critical Illness, Dental & Vision

Do not leave your family unprotected. Get quotes right now for affordable Term life insurance which will leave your family financially secure if you are no longer there to provide for them. Watch the video to the left to determine how much Life insurance you actually need. Click the image below for Life insurance, Critical Illness, Dental & Vision quotes.

GUARANTEED ISSUE LIFE INSURANCE

If you are uninsurable due to preexisting conditions, you can now purchase guaranteed issue Term life insurance up to $150,000 or Whole life insurance up to $250,000 with no health questions, no exam. Please click the image below to view quotes. Please contact us for more information.

Life insurance with “Living Benefits”

Life insurance is an important way to protect your loved ones. But for many families the need for protection is increasingly due to costs associated with the rising incidence of illnesses like strokes, heart attacks, cancer and other chronic and critical illnesses. More families are dealing with the unexpected costs that illnesses such as these place on them and their families. People need access to funds while they are alive to cover costs that their health insurance does not cover such as mortgage payments, car payments, groceries, utilities and other daily living expenses.

Why Do I Need Living Benefits?

Statistics show that large numbers of Americans may become terminally, critically or chronically ill.

Chronic and critical illnesses may result in the inability to perform activities of daily living such as bathing or dressing yourself without help or assistance. While many of us have health insurance, medical bills continue to be a leading cause of bankruptcy in the United States. Watch the Butler’s story about how their policy with “Living Benefits” literally saved their family fortune. Click the image below for critical illness quotes as well as Life insurance quotes which contain accelerated benefits for a critical illness.

Life insurance with living benefits provides the option to access the face amount and receive cash while the insured is alive. The Accelerated Death Benefits can provide funds at a time that the insured and his/her family need them most. Most life insurance policies only protect your family after you pass away. A life insurance policy with living benefits still does that but may also give you valuable access to cash while you are alive, and when the funds are most needed. People see this as a smart way to have funds they need without having to access a retirement fund, 401(k) or liquidate CDs. Once you decide on a plan you like, you can apply quickly and easily online using this link or click contact us for a free no obligation quote customized for your specific needs.