Short Term unsafe to buy in Illinois before July 1

On October 12, 2017 President Donald Trump signed Executive Order #13813 designed to restore consumer choice in the non ACA-qualified Short Term health insurance marketplace. Short Term health insurance is considered major medical health insurance but it is not ACA-qualified. As such, Short Term health insurance does not cover preexisting conditions and you must answer health questions in order to qualify. As of October 2, 2018, President Trump’s Executive Order became the new Federal regulation. Afterwards, Short Term policies that keep you consistently insured for up to 360 days became once again available for all Americans to purchase. States retain the right to accept or reject the Trump restoration of Short Term policies.

Wisconsin, Indiana, Texas, Arizona and 23 other state regulators accepted the Trump restoration. Their residents can purchase Short Term health insurance for up to 12 months with the option for two guaranteed renewals which equates to 36 months of consistent health insurance coverage. Short Term health insurance is safe to purchase in those states for now. That stated, the Biden administration is currently seeking to reverse President Trump’s executive order. If the Biden administration is successful in doing so, Short Term policies would then be limited to only 3 months in maximum duration in all states. This presumes that legislators in Republican led states do not push back. The chances are good that they will.

SHORT TERM UNSAFE TO BUY IN ILLINOIS WITHOUT PROPER PLANNING

From October 2, 2017 to December 14, 2018 Illinois residents were able to purchase Short Term policies for up to 360 days thanks to Illinois Governor Rauner’s VETO of HB2624. HB2624 was the Illinois Democrat led attempt to block the Trump restoration of Short Term policies. Unfortunately, after Rauner lost his reelection bid, Illinois Democrat Senator Antonio Munoz began working to undermine President Trump’s restoration of Short Term policies. Munoz’s effort was unfortunately successful. As of December 14, 2018, Public Act 100-1118 prohibits Illinois residents from owning Short Term policies for more than 180 days.

This regulation leaves Illinois consumers who do not qualify for Federal health insurance subsidies with no other safe option but to purchase ACA-qualified health insurance at a premium that is not only not “affordable” but now exceeds their mortgage payments. A Short Term policy purchased on January 1st which lasts for only 180 days exposes consumers to unique and significant risk by potentially leaving them uninsurable in the middle of the year if upon exhaustion of that policy they are too sick to qualify for another 180 day Short Term policy. In this case, they would be left uninsured for the remainder of the year until the health insurance exchanges open again in the fall. There is however a way to ensure small business owners have access to health insurance that covers preexisting conditions at any time throughout the year. This can be accomplished by ensuring you have the proper business structure in place to purchase group health insurance.

PLEASE NOTE: Since Group health insurance is available all year long and covers preexisting conditions. It is absolutely essential for Illinois residents who plan on continuing to purchase Short Term health insurance to ensure they have the proper business structure in place in order to be able to purchase group health insurance at any time throughout the year. This way, when a six month Short Term policy ends (at the end of June for example) you will be able to purchase group health insurance if at that juncture you or a family member becomes too sick to qualify for another Short Term policy. Since Short Term policies do not cover preexisting conditions, it is extremely important to have your company properly structured ahead of time so that you can purchase group health insurance at any time should you need coverage for preexisting conditions. As few as two people can purchase group health insurance, even husband and wife teams who have no employees. To learn how to structure your small business in order to ensure you have coverage for preexisting conditions at any time throughout the year, please call us directly at (630) 674-1551. Or, click “Contact” above to email us.

Below is more information about United Healthcare’s non ACA-qualified Short Term health insurance policies:

United Healthcare’s non ACA-qualified Short Term health insurance policies are the most comprehensive non ACA-qualified Short Term health insurance policies in the industry. Unlike other non ACA-qualified policies, these policies cover outpatient prescription drugs and your health plan deductible is waived for Urgent Care visits. United Healthcare also covers each insured member to $2,000,000. United Healthcare’s Short Term policies also include their national “Choice Plus” PPO network which includes in network access to Chicago’s Teaching hospitals such as Northwestern Memorial, University of Chicago, Rush university medical center and the Lurie Children’s hospital. You can search for in network PPO providers within United Healthcare’s Choice Plus PPO by clicking here. United Healthcare’s best designed plan is their “Short Term Medical Plus Elite” plan which provides 100% coverage after the deductible has been satisfied. It also provides a “first dollar” (no deductible required) benefit for outpatient Urgent Care visits. For quotes and to apply online click the United Healthcare logo below:

Another unfortunate consequence of Public Act 100-1118 is that Illinois consumers can no longer purchase another 6 month Short Term health insurance policy from the same insurer (after their initial 6 month Short Term policy ends) without a 60 day coverage gap between policies. This means that those who have a United Healthcare Short Term policy now must purchase their second 6 month Short Term policy from a different insurance company. The second best priced and best designed Short Term health insurance carrier in Illinois is Allstate Health Solutions (formerly National General). Allstate’s Short Term policies also include a national PPO network. That network is Aetna’s Open Choice PPO network. It also includes in network access to Chicago’s Teaching hospitals including Northwestern Memorial, University of Chicago, Rush university medical center and the Lurie Children’s hospital. You can search for in network providers PPO providers within Aetna’s Open Choice PPO network by clicking here. For quotes and to apply online click the Allstate Health Solutions logo below:

Allstate Health Solutions now offers 36 month Short Term health insurance policies in the state of Indiana (and 26 other states) which includes two guaranteed renewals with a level premium that will not increase for 36 months.

PLEASE NOTE: There are two other health insurance carriers offering Short Term health insurance policies in the state of Illinois. They are Independence American via IHC – Independence Holding Group and “Pivot Health” products via Companion Life insurance company. These carriers offer Indemnity policies on a Short Term basis. Indemnity policies do not include a PPO contract. These Indemnity policies pay reasonable and customary charges only. Without a PPO contract included with your policy, a medical provider can balance bill you for charges above the reasonable and customary amount. For this reason we do not recommend purchasing Short Term Indemnity policies from Independence American or Companion Life.

Please also note: Non ACA-qualified Short Term health insurance plans are not required to cover certain “Essential Health Benefits” that are covered with ACA-qualified plans. These benefits are:

1.) Maternity and newborn care

2.) Mental health and substance use disorder services

3.) ACA mandated Preventive care benefits. However, routine mammograms, birth control and cancer screenings ARE COVERED with non ACA-qualified Short Term health insurance policies in states like Illinois where these Preventive care benefits are mandated.

4.) Pediatric Services (including both oral care and vision care).

The ACA (Obamacare) Individual Mandate was REPEALED by congress on 12/20/17. The Tax Cuts and Jobs Act of 2017 zeroed out the Individual Mandate on January 1, 2019.

Determining your eligibility for subsidies

The 2024 ACA (Affordable Care Act) open enrollment period begins on November 1, 2023 and ends on January 15, 2024. Depending on your total household M.A.G.I. – Modified Adjusted Gross Income – you may qualify for an A.P.T.C. – Advance Premium Tax Credit which will reduce your cost for health insurance. Advance Premium Tax Credits (federal health insurance subsidies) have increased significantly since April 1, 2021 due to the passage of the American Rescue Plan. Those enhanced subsidies have been extended until 2026 due to the passage of the I.R.A. – Inflation Reduction Act. Depending on your income, you may find a more affordable plan even if you earn a substantial income. To see if you qualify for a federal subsidy click here. You will be able to shop all carriers, choose a plan, get your subsidy and finish the process much faster than working solely with Healthcare.gov. You can also purchase ACA-qualified health insurance policies without subsidies using the same link if you do not qualify for Advance Premium Tax Credits.

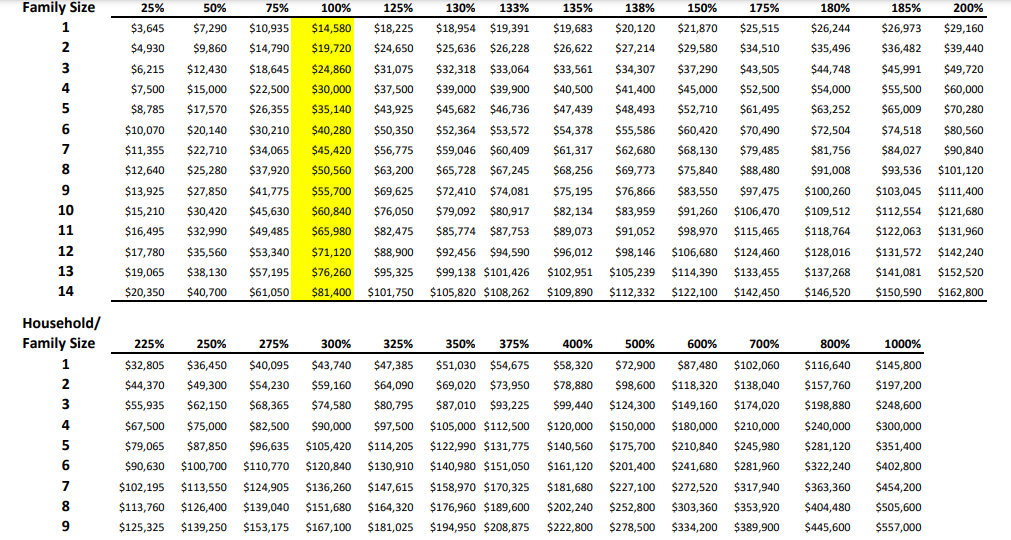

Please note: If your income is lower than the Federal Poverty Level Information in your state, which is less than 138% of the FPL – Federal Poverty Level in states that expanded Medicaid and less than 100% of the FPL in states that did not. You will be offered Medicaid and as such will not be able to qualify for subsidized private health insurance. You can purchase private health insurance even if you qualify for Medicaid but you must do so without a subsidy. Click the chart below to determine the current Federal Poverty Level and percentages above it.

Please note: If you qualify for a federal health insurance subsidy and your state has expanded CHIP – Children’s Health Insurance Plan – you may not be able to insure your children on your policy. Healthcare.gov will instead send a referral to your state’s CHIP program. In Illinois, that program is “All Kids Covered“. You may wish instead to purchase private health insurance at full price for your children if you cannot find a Pediatrician who will accept “All Kids Covered”.

Preventive Care: All ACA-qualified (Obamacare) health insurance policies must cover the following list of preventive services without charging you a copayment or coinsurance. This is true even if you haven’t met your health plan deductible. Click here to see the list. Be sure to click on “For all Adults”, “For Women” and “For Children” to see entire list.